Remember last time U,.S. GDP numbers were releases with great fanfare showing a growth of 3.2%? They have now been quietly revised down to 2.8%, and that is not even the final revision. This also gives the chance of the next GDP number being higher, since it starts from a lower base. And the process can then continue.

It turns out that there were deeper spending cuts by both state and local governments in Q4 2010. The revised estimate by the Commerce Department showed that state and local governments cut spending at a 2.4%.

Consumers also spent less than what was originally reported, rising 4.1%, versus the previous number of estimate of 4.4%.

For 2010, the economy grew 2.8%, the highest in 5 years (although 5 lousy years).

Monday, February 28, 2011

The Last "Great" U.S. GDP Is Now Revised Down From 3.2% to 2.8%

Thursday, February 24, 2011

Profitting From Oil Rising Further or Dropping: Volatility Rules

Oil has soared on the unrest in Lybia. Saudi Arabis is now discussing increasing oil production to prevent further price increases. The situation is highly volatile, a prime case for straddles.

Here are straddles for our favorite oil ETF, UCO.

Computed with StraddlesCalc tool.

Options are dangerous and may cause 100% loss. Please do your own due diligence.

VISA: Your Current Debt Will Take 109 Years to Be Repaid!

VISA takes the prize this time. My credit-cards are all set an auto payments to pay the full amount every month. However, please take a look at what happens if you only pay the minimum amount:

It would take 109 years+ to repay the debt!

The sad thing is that some people do pay the minimum amount (is that like the U.S. debt?).

Interesting, that the amount above would not be repaid in my or in my kids life time.

Wednesday, February 23, 2011

Gold Analysis Now: Sell or Go Short; Gold in Trading Range

Here is the latest gold and silver analysis by INO. INO says it's not so smart to invest in gold now. Gold is now in a trading range:

The video is 4 minutes long and explains a better "short gold position." It does not mean they are bearish on gold, however the scenario could make money by being short gold and long something else.

This an interesting twist.

Watch video.

Enjoy.

Tuesday, February 22, 2011

BAC Shares Take Beating: New $20B Writedown, Now On Credit Cards

Another sign that not all is good in the U.S. What's a billion these days... BAC, practically doubled a goodwill impairment for its credit-card unit to $20.3B due to increased defaults..

The bank restated its federal regulatory filings to record the writedown. Says Bloomberg: "The non-cash charge, which replaced a $10.4 billion impairment booked on the unit last year, doesn’t affect “the financial results, safety and soundness or the capital position” of the Charlotte, North Carolina-based parent company, said Robert Stickler, a spokesman".

"The writedown shows the credit-card unit’s prospects may have deteriorated more than initially disclosed after the U.S. passed legislation, known as the Card Act, in May 2009 to curb fees and interest-rate increases. In November, the bank said some measures would cut annual revenue by $1 billion, undermining efforts by Chief Executive Officer Brian T. Moynihan, 51, to improve returns for investors. The firm yesterday said the act and “deteriorating credit quality” caused the revision".

The restatement, covering the eight quarters of 2009 and 2010, was made in reports filed with the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp., Bank of America said".

The bank's shares took a beating today, along with other financials:

Tensions in Mideast: Using GLD and Yamana Gold, and UCO for Oil

The current tensions in the mideast have cause commodity prices to soar or at the very least become very volatile. Above are current straddles (strangles) for gold and oil, in the form of the popular GLD ETF, as well as our favorites, Yamana, and UCO.

Please do your own due diligence. This is not advice. Options are very dangerous and may cause 100% loss. Computed with StraddlesCalc Tool

Home Prices in U.S. Drop To 2009's Lows, 6 Straight Months of Declines

The latest report from the S&P/Case-Shiller confirm that the recovery in the U.S. is still very shaky. Home prices have dropped for 6 straight months, and dropped 4.1% just in the last three months of 2010.

Seasonally adjusted, the national index surpassed its the low it hit in Q1 2009.

The decline was widespread, 18 of the 20 large cities had losses for the year. The only gains were posted by Washington, +4.1%, and San Diego, +1.7%.

Detroit was the biggest loser, with prices dropping a staggering 9.1%.

Monday, February 21, 2011

Spain's Banks Have 100B Euros in Problem Assets

The above is a chart of unemployment in Spain.

The Bank of Spain said today that the while total exposure of Spanish savings banks to real estate and building is about 217 billion euros (USD $297B), 100 billion euros is classed as “potentially problematic,”

The gap between Spanish and German borrowing costs spread higher to 216 basis points today (Bloomberg).

Miguel Angel Ordionez, Bank of Spain Governor said that international investors don’t always understand Spaniards’ "track record of paying off their mortgages", and that they mistakenly compare Spain with other countries where it is easier to walk away from mortgage debts.

Bad loans on mortgages reached 4% after the last banking crisis in the 1990s, and amounted to 2.5$ in September last year, according to the bank.

Friday, February 18, 2011

Roubini: G20 in Disarray, There is No Global Leadership; China

Ubiquitous economist Nouriel Roubini was on CNBC again discussing the G20 finance meeting:

- There is just disagreement. The U.S. is too weak with its deep fiscal problems.

- Interesting discussion on China's being number 2 economy and GDP per capita. Breaking up China, Shanghai's per capita is $14,000..

- China's consumption can still rise significantly.

G20 Currency Wars are Back: Brazil to Veto Proposed Changes That Favor Europe and U.S.

Brazil will not accept the establishment of global guidelines to control the flow of capital at the meeting of ministers of economy and central bankers from the G-20 (the 20 most influential countries in the world), which begins today in Paris.

Brazil also will accept no limits to the accumulation of international reserves.

The two issues are seen by the Brazilian negotiators as the greatest potential for friction between developed and developing countries. If the Brazilian veto the proposals continues, the two issues will not be part of the summit of the G-20, in November in Cannes.

The Brazilian position wasconfirmed by sources involved in the negotiations. With regard to capital flows, the country will only accept the creation of a 'manual' that includes examples of national policies. In the case of Brazil, Tax on Financial Operations (IOF), raised from 2% to 4% in November 2010, would be included. This tax focuses on foreign investments in fixed income and equity.

In its proposals for the G-20, France defedns the "better regulation of capital flows"- in practice, an elimination of the implemented actions.

On Monday, the French Economy Minister Christine Lagarde suggested that measures to control the flow of capital used in Asia, are protectionist. "Countries like Brazil and South Korea have deployed barriers or obligations to limit international capital flows. One must question the nature of those obligations."

France is of course happy to have the Euro devalued, and so is the U.S. as the U.S dollar sinks.

These measures cannot be accepted by emerging nations.

Mega Stock Exchanges: Brazil and China's Stock Exchanges To Link

The world is unifying, even at the stock exchange level. This has certainly been a month of stock exchange mergers and acquisitions and deals. On Tuesday, NYSE Euronext and Deutsche Boerse formally announced plans to merge, a deal that would create the world's largest stock exchange operator. Earlier this month, the London Stock Exchange and Toronto Stock Exchange also agreed a merger deal.

Today comes a new announcement (BBC). While not a merger, the Shanghai Stock Exchange and Brazil's BM&F Bovespa will sign an agreement next week that will bring the two exchanges closer.

Bovespa, already the world's fourth largest and growing by leaps and bounds, said it was looking for cross-listing across both exchanges.

Bovespa said the objective of the deal was "to initiate a common discussion about business opportunities and exchange information".

We track all Brazilian ADRs live here, Brazilian ETFs, and Chinese ETFs.

Thursday, February 17, 2011

EU: Portugal Now Seen as Requiring a Bailout By April

Reuters reports that European Union member states are very concerned about Portugal's ability to fund itself and believe Lisbon will need to a bailout by April.

Trouble is, Portugal has so far refused to discuss that need. "The EU has discussed a rescue plan for Portugal, but it is dependent on Lisbon asking for the aid and making that request to both the EU and the International Monetary Fund. Portugal remains adamantly opposed to asking for assistance".

"Portugal is drowning, it's not going to be able to hold on beyond the end of March," the euro zone finance source said. "That's already understood to be the case in financial markets, but now it's also understood among (EU) finance ministers."

"Portuguese officials have said in recent days that it is up to Europe as a whole to resolve the debt crisis, sending the message that if the EU can agree a "comprehensive package" to tackle the crisis by a summit set for March 24/25, that will help Portugal weather the pressure from financial markets.

Cabinet Minister Pedro Silva Pereira repeated that line on Thursday, saying that Portugal was doing all it could to cut its budget deficit and that it was now up to the rest of the euro zone to do its bit and agree the "comprehensive package".

"Any delay of an effective European response to confront this situation damages all the countries and the euro itself," Silva Pereira told reporters after a cabinet meeting.

"That is why our message is that Portugal is doing its work. Europe also needs to do its part."

"Portugal is so far managing to fund itself at the short end of the yield curve, but the cost of borrowing is now close to or at record highs and is becoming increasingly punitive."

Food Prices Skyrocket And Why and How You Should Invest in Farm Land

One of the topics this blog focusses is on food and commodities. Related to food is of course farm land. The Financial Post has a report on the top five reasons you should invest in farm land, for the same reasons we have writtwen about here.

Besides commodities in general (live tracking). Note that we are investors of Cresud chart above), basically farm land in Argentina, when the stock was about $8.

Says the FP:

"It may seem a radical investment made by those who believe the end times are coming, but with food prices soaring, farmland could be on the brink of a serious bull market.

It's not just investors like Jim Rogers in the market, but countries too seeking to secure their food future.

Of course farmland investment comes with its own challenges. It requires a long-term commitment. Weather is volatile, and could slam your investment in the short-term.

But if you have the patience, and the money, farm land could be of huge use to you.

1. Food Demand is Rising

This is the China story we have commented about so many times. The Chinese are getting richer, and are eating better. There is not enough land in China to produce what they need (see also our post earlier this week on why they are buying Africa).

"The fact that food inflation leads core inflation in most countries reflects the rising demand for food and soft commodities, like corn and wheat. With food security threats sovereigns are rushing in to buy up land and farmland is becoming increasingly scarce".

2. Inflation

"Farmland is like gold, because there's a limited amount in the market a demand causes a jump in prices. Globally, it has appreciated at a rate 2% higher than inflation since the 1950s according to Marketwire".

3. Returns

"The NCREIF Corn Belt Farmland Index has had total returns of 11.43% from January 1991 to December 2008 according to Agrinuity".

4. Diversification

"Developed markets are a better fit for investors concerned solely with wealth preservation, according to a report by Savills, even though values are higher, reflecting the sophistication of the agricultural industry. These include Western Europe, USA, Canada, Australia and New Zealand".

5. Tax breaks

"In the U.K. income off farmland investment benefits from tax planning advantages like IHT (inheritance tax) relief if you've lived on the land for two years. Property owners also benefit from a business relief for 5 years if their farmland makes a loss. The U.S. and Canada offer tax incentives as well."

Argentina

They also report on Argentina.

"Argentina offers some of the best quality land in South America and gives investors legal titles.

Argentina's farmland value has appreciated 10% in 2010 and can cost up to $14,000 per hectare (approximately 2 1/2 acres) according to UPI.com. With upcoming elections in Argentina and potential policy changes to farmland investment, people are looking to Uruguay as well where prices can range anywhere from $3,750 - $9,000 per hectare, according to Savills.

DGC Business Consulting Ltd. has 5 - 10 year investment options in Argentinian farmland starting at $16,000, which promise up to 14% annual returns".

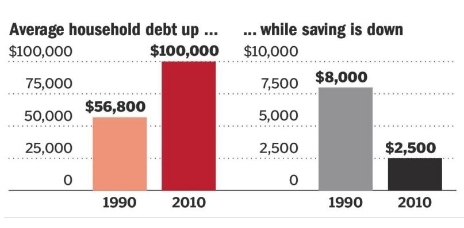

Canadian's Debt Soars, Hits 150% of Income, Now Matches U.S. Level

Canadian families' average debt has hit 100,000, the first time at six figures, accordig to a report by the Vanier Institute of the Family. The figures include mortgages.

The report also says that debt-to-income ratio is 150%, so Canadian families owe $1,500 for every $1,000 in after-tax income they make.

The average mortgage in 2010 was $171,500. Sauvé said the average household has a mortgage of $63,126 because not everybody actually has a mortgage.

Current debt levels are 78% higher than in 1990, when the average household debt was $56,800. Savings have also shrunk, in 1990 families saved 13%of their income, or $8,000, compared to a savings rate of 4.2% in 2010 ($2,500) .

Canada's debt-to-income ratio is now about even with that of the United States.

Wednesday, February 16, 2011

Gold Soars as China Buys Record Gold: To Overtake India as Top Physical Buyer

Gold is approaching new highs and has risen substantialy in recent weeks. Gold prices jumped 30% in 2010 (in USD) and reached an all-time high of $1430.95.

A contibutor to this situation is China, where demand for physical gold and gold-related investments is growing at an explosive pace and "its appetite for the yellow metal is poised to remain robust amid inflation concerns", says a Reuters report, citing said an Industrial and Commercial Bank of China (ICBC) executive.

We track all gold ETFs live here.

ICBC is actually the world's largest bank by market value, sold about 7 tonnes of physical gold in January this year, nearly half the 15 tonnes of bullion sold in the whole of 2010. The bank says they are seeing explosive demand for gold as Chinese get wealthy and look to diversify their investments. Gold is also a hedge against inflation..

"There is also frantic demand for non-physical gold investments. We issued 1 billion yuan worth of gold-price-linked term deposits in 2010, but we managed to sell the same amount over just a few days in January this year," the bank's Zhou said, also adding that such deposits would easily exceed 5 billion yuan ($759 million) this year.

"Gold imports into China soared in 2010, turning the country, already the largest bullion miner, into a major overseas buyer for the first time".

China Overtaking India as Gold Buyer

What is quite notable is that this move puts China on track to overtake India as the world's top gold consumer.

Mr. Zhou also said China's gold demand could grow at a stronger pace this year, with volatile stock markets and moves by the government to rein in property speculation and purchasescausing more investors to move their cash into bullion.

"Unlike the property market, investment in the gold sector is something the government is encouraging,"

China has encouraged retail consumption and announced last August measures to promote and regulate the local gold market, including expanding the number of banks allowed to import bullion.

"China has a centuries-long cultural attraction to gold and because we have started at such a low base, I think demand growth will likely stay strong for quite some time,"

Mr. Zhou said there was also voracious demand for silver, with the bank selling about 13 tonnes of physical silver in January alone, compared with 33 tonnes in the whole of 2010.

The scale of China's gold demand, which has increased on average at a double-digit clip over the past decade, has caught the market by surprise. Data showed China imported 209 tonnes of gold the first 10 months of last year, versus 333 tonnes by India for the whole year.

The bank on Tuesday launched its second physical gold investment product, which sells gold bars to investors, which can be resold for cash through ICBC based on real-time gold prices.

The WGC said ICBC's introduction of this gold investment could lift China's gold retail investment by 10 to 15 percent in 2011 from about 170 tonnes last year".

Geithner: U.S. Needs To Massively Cut Corporate Taxes!

This is quite something. Just one day after the White House unveiles a budget that seeks to really cut the country's massive deficit, Tim Geithner says that Congress has to work overhaul the tax code, and reduce corporate taxes substantially!.

Geithner said that the United States needs to cut the corporate tax rate to the high 20% range, down from the current 35%.

"We are very serious... in trying to build consensus now on a set of fundamental changes to the corporate tax system that would improve incentives for investment," "The average rate of our major trading partners now is in the high 20s and... to make it meaningful you want to get it down substantially toward that level,"

Reuters: "Obama's own fiscal deficit commission recommended cutting the top corporate rate to between 23 and 29 percent, while trimming business tax breaks.

The president did propose squashing some of these breaks in his 2012 budget, but the ideas have failed to garner support in Congress for several years.

A big stumbling block is that Obama wants to overhaul corporate taxes without adding to the deficit, expected to top $1.5 trillion this year. That will create inevitable winners and losers in the business community, dragging out the process".

Tuesday, February 15, 2011

Apple's Arrogance Reaches New Levels: Subscriptions Apps Through ITunes

And the latest arrogance from AAPL: Apple is saying that if publishers want to sell digital newspapers and magazines for the iPhone and iPad, they must give customers the option of paying through its iTunes store, for which AAPL receives a 30% cut on sales!

“All we require is that, if a publisher is making a subscription offer outside of the app, the same (or better) offer be made inside the app,” Apple Chief Executive Officer Steve Jobs (on medical leave!)

Also Apple recently rejected Sony Corp.'s e-book reader app for the iPhone because it doesn't give people the chance to buy books without leaving the app for a website.

The company is becoming the old arrogant MSFT, which half the world used to hate, and they made rivers of money on the other captive half.

Gold is Lifting Off This Morning

The chart says it all, gold and the miners are taking off:

We track gold ETFs live here. and the miners live here.

U.K.'s Inflation Jumps to 4.0%: Twice the Target

The UK's inflation reached double the target of the Bank of England (BOE) in January, increasing pressure for the central bank to raise interest rates. According to the Office for National Statistics, the consumer price index rose 4.0% compared with January last year after an annual high of 3.7% in December. That was the biggest advance since November 2008.

The main factors behind the high inflation were the crude oil costs and rising sales tax.

The chairman of the BOE Governor Mervyn King today will send an open letter to British finance minister, George Osborne, to explain how the central bank will react to inflation so far above the mid-term target of 2.0%.

Compared to December, prices rose 0.1% in January. This was the first time that there was an increase in inflation from January to December since records started being made in 1997.

Monday, February 14, 2011

Forget Bernanke: MIT Says Online Inflation Jumps in The U.S. in 2011

While Ben Bernanke still says there is little sign of inflation, consumers know what they are paying for necessities. The MIT publishes an inflation index that is based on available and reliably measurable online prices.

Prices have risen sharply in 2011:

Since the beginning of the year, prices have gone up 1.43%. Extrapolated over 12 months, this is equivalent to approximately 12.0%/year.

Details of the methodology can be found here.

"Data collection: our data are collected every day from online retailers using a software that scans the underlying code in public webpages and stores the relevant price information in a database. The resulting dataset contains daily prices on the full array of products sold by these retailers. Our data include information on product descriptions, package sizes, brands, special characteristics (e.g. “organic”), and whether the item is on sale or price control.

Daily Online Price Index Computation: The daily online index is an average of individual price changes across multiple categories and retailers. The index uses a basket of goods that changes over time as products appear and disappear from a retailer’s webpage. It is updated on a daily basis and leveraged to estimate annual and monthly inflation. This index is not designed to forecast official inflation announcements, but to provide real-time information on major inflation trends".

U.S. Interests Paid on Its Debt to Triple, to $554B

It is well known that the humongous budget deficits are are a ticking time bomb. The U.S. Treasury Department now says that what it pays to service the national debt will triple amid record budget deficits.

Interest expenses will rise to 3.1% of GDP by 2016, and to an all-time high of $554B in 2015, from the current 1.3% in 2010, or $185B.

The government forecasts to run cumulative deficits of more than $4T through the end of 2015.

Current interest rate expenses have been relatively low (and that is a big "relative"), in spite of the massive debt, because rates have been kept so low.

However, as per Bloomberg report, bond yields are now rising.

"The amount of marketable U.S. government debt outstanding has risen to $8.96 trillion from $5.8 trillion at the end of 2008, according to the Treasury Department. Debt-service costs will climb to 82 percent of the $757 billion shortfall projected for 2016 from about 12 percent in last year’s deficit, according to the budget projections. "

"That compares with 69 percent for Portugal, whose bonds have plummeted on speculation it may need to be bailed out by the European Union and International Monetary Fund".

Please note that we track bond ETFs live here.

Sunday, February 13, 2011

China Invades Africa; 10X Investments in 10 Years, 0.8M Chinese Live in Africa

As we have stated here, the next major global growth will not be in the BRICs. The next giant economic growth will be in Africa. If you had any doubts, please read on.

Beijing has launched Nigeria's first satellite, built new buildings of public administration in Algeria, ended the road that Osama bin Laden began in Sudan before fleeing to Afghanistan, built over 100 schools throughout Africa and has even financed prisons whereAfrican dictators silence the opposition.

None of this happened by chance.

Ten years after establishing Africa as a priority, China trasformed the map of the continent, and is now its main economic partner and had surpassed for the first time the former colonial superpowers.

China is buying its future in Africa.

The continent is seen by the Chinese today just as the springboard to allow China access to natural resources, food and energy to maintain its growth pace in coming decades, and eventually surpass the U.S. economy .

Just as the far west promoted the economic and productive transformation of the United States and gave access to new sources of natural resources for over a century, Africa now plays that role for China, which it believes that in 20 years will supply 50 % of its energy.

To achieve this access, Beijing must deal with corrupt governments, dictators and failed states. The strategy is clear: do not ask questions about domestic issues or require, as the World Bank does, commitments to democracy or transparency in government accounts.

The tactic is beginning to achieve concrete results. 2010 ended with trade of $100 billion between the two new partners. The flow hass simply multiplied by ten in just ten years.

In an unprecedented "safari", China broke European monopolies in African countries, injecting new growth in the economies of the region and has opened a new "logic" in Africa, at the very time that the continent marks the 50th anniversary of decolonization.

Strategy.

With assets of U.S. $ 2.4 trillion from the state and with no shame in stating that it is a state project, the Chinese strategy in Africa is not merely one of establishing a "colony of exploitation." The finding of all is clear: China has arrived in Africa to stay.

There are already 800,000 Chinese living in the continent. Many are merchants and industrialists who want to enjoy Africa's already lower wages (lower than those of China). The goal is to have 50 Chinese industrial zones in Africa in ten years. Another fact is the invasion of Chinese products on supermarket shelves, providing a breakthrough in relations with the authorities and into the homes of millions of Africans.

Another reality that literally changes the landscape is the landing of Chinese construction companies, financed by the treasury from Beijing to simply win all the works in public bidding. Giant Brazilian companies, as Camargo Gutierrez, do not hide the difficulties in competing for contracts with the Chinese in Africa today.

With news from O Estado de Sao Paulo.

Saturday, February 12, 2011

Egypt Volatility: Opportunity in Oil ETFs; The Top ETFs To Buy and To Sell

The situation in Egypt has caused oil to spike up and come crashing down. If you have filled up your car recently, you know how this has affected your pocket.

The price volatility has also deeply affected oil ETFs. We computed the RSI value of oil ETFs and have sorted them for short term and long term investments.

Please note that we track all oil ETFs live here.

Below is the current status of oil ETFs in term of overbought and oversold conditions.

LONG TERM:

These are the results sorted by monthly values.

Most oversold is DDG. Most overbought are OIH and DIG. (please click on each stock ticker links to receive buy/sell alerts and technical analysis on them).

SHORT TERM:

These are the value sorted by daily values:

The two most oversold are HOU and USO. The most overbought are DNO and DTO.

Friday, February 11, 2011

Oil: Petrobras Hits New Record Gasoline Production

Oil giant Petrobras, PBR on the NYSE (click for alerts and Technical Analysis), said today that it hit a new record production of gasoline type A in January, with 1.816 billion liters, an increase of 2.36% over the previous mark of 1.774 billion liters, obtained in December 2010.

PBR has the largest ever global IPO last year.

In a press release, Petrobras said that "this record is the result of the company's efforts to supply the Brazilian market without resorting to imports."

To achieve this goal the company has changed the operating conditions of its process units and has optimized mixtures of naphtha. Gasoline was the fuel processed by the com[any that had the largest increase over the previous year, about 15%, driven mainly by economic growth and the high price of ethanol.

Thursday, February 10, 2011

Irish Banks To Require Yet Another 50B Euros in New Bailout

The neverending situation in Ireland keeps getting worse. Today AIB, Anglo Irish Bank Corp., said the nation’s lenders may need about a further 50 billion euros of capital, "more than absorbing the 46B Euros that the Irish govt. has already poured on the bailout fund for the banks.

Bloomberg: “A clean banking core will require something in the region of 50 billion euros,” Dukes, AIB Chairman and former finance minister, said in an e-mailed copy of a speech today. “A clean banking restructuring implies the acceptance of irrecoverable losses.”

"The state has injected 29.3 billion euros into nationalized Anglo Irish. Dukes, appointed as chairman in June, said the remaining “black hole” in the Irish financial system may amount to between 20 billion euros and 40 billion euros".

Filling that gap requires “long term 20 year to 30 year funding, on which there will be no return,”

Natural Gas: Huge Drop in Storage But Contango Rules; UNG

Natural gas inventories showed a very large drawdown of 209 Bcf today.

Current storage levels are now below last year, as well as below the 5-year average, please see above chart. The situation would be quite bullish for natural gas prices, however, there is a the terrible UNG-destroyer contango in effect.

The Silly Latest Unemployment Figures: Initial Claims Drop, Extended Rise!

The latest foolish unemployment numbers were releaed today showing that Americans filing first-time claims for unemployment insurance "fell to the lowest since July 2008".

The jobless rate declined to a 21-month low, if you are to trust those figures. The numbers are going up and down like a yo-yo lately and have become largely irrelevant, hwoveer, the media goes crazy, and so do the markets when they are relased.

Bloomberg reports. "Applications for jobless benefits decreased by 36,000, more than forecast, to 383,000 in the week ended Feb. 4, Labor Department figures showed today. Economists forecast claims would fall to 410,000, according to the median estimate in a Bloomberg News survey. The total number of people receiving unemployment insurance fell, while those collecting extended payments increased."

Please do take a look at that last sentence:

"while those collecting extended payments increased""A slowdown in firings means U.S. companies may begin creating enough jobs to keep unemployment going down after the rate’s biggest two-month decline since 1958. Federal Reserve Chairman Ben S. Bernanke yesterday said the jobless rate will likely stay high “for some time” as companies remain reluctant to add to payrolls".

If things are improving, would that be the case?

Tuesday, February 8, 2011

The U.S. Exports Food and Oil Inflation: Inflation Rate Jumps in Brazil

While inflation ithe U.S. remains at tepid rate and the fed does not know if it is deflation or inflation it needs to fight, or create, inflation in other countries such as in Asia and Brazil are jumping as food and oil rise.

Brazil's inflation, as measured by the National Consumer Price Index (IPCA), jumped to 0.83% in January (that's for asingle month!), compared with 0.63% in December. This represented the highest rate since April 2005 when the index rose by 0.87%.

Over the past 12 months through January, the IPCA index is up 5.99%.

Food and Beverage Transport and were responsible for the greatest pressure on the IPCA in January (0.83%), according to the IBGE (Brazilian Stats Institute) said. Both groups - the Food and Beverage and Transport - contribution amounted to 0.56 percentage point in the index, which equals 67% of the IPCA in January. The group of Food and Beverage 0.27 percentage point and accounted for Transport, 0.29 percentage point.

We track all Brazilian ETFs live here.

Inflation Rises Again, China Raises Interest Rates For 3rd Time in 4 Months

The People’s Bank of China has just announced that the 1-year lending rate will increase to 6.06% from 5.81% effective tomorrow. This is the the third time since mid-October that China has raised interest rates, "ahead of a report forecast to show inflation accelerated to the fastest pace in 30 months" (Bloomberg)

China joined India, Indonesia, Thailand and South Korea in raising rates this year, as well as Brazil.

The yuan climbed 0.1 percent to 6.5555 per dollar.

The ETF that tracks the Yuan is CYB. We track all currency ETFs live here.

Monday, February 7, 2011

Geithner: Brazilian Real Overvalued Because Of China, Fails To Mention Low Rates In the U.S As Cause

At leats thast is what he implied during his visit to Brazil today. Mr. Geithner attributed Brazil's recent trade problems to countries "that understand the value of having an undervalued currency", seen as clear reference to China's yuan.

Seeks to work together against China

He said: "We have a common interest with Brazil and other emerging economies that growth is balanced,"

"Brazil and other emerging markets cannot address these challenges by their own policy choices alone," "It's now more important than ever that we work together."

New President Dilma Rousseff has identified China's undervalued yuan as one of the biggest threats to Brazil's economic boom due to a flood of cheap Chinese imports.

Ms. Rousseff is due to visit Beijing in April where she will raise the issue of the undervalued yuan, according to officials.

Geithner also said that countries such as Brazil that face an "out-sized burden" due to their strong currencies "may need to adopt carefully designed macroprudential measures"

Brazilian press comments not so flattering

However, Brazilian press wrote that Mr.Geithner did not commnet on the ultra-low interest rate policy and cheap money and stimulus that the U.S. has. That is clearly another reason for monety to seek other countries.

KRY: Crystallex's Sad Story Finally Ends. Caput

Crystallex (KRY), the once touted stock of the year, announced on the weekend that they have received a letter from the Corporacion Venezolana de Guayana that states that the Company's Mine Operating Contract for the Las Cristinas Project in Bolivar State, Venezuela, has been "unilaterally terminated" by the CVG.

The letter states the reasons as being that no activity was being performed on the mine, but that it was for "opportunity and convenience".

KRY says that no work was being done because they were still waiting for the infamous environmental permit.

The company says it may go for international arbitration, and so on. Against the Chavez government?

A sad story ends.

Wednesday, February 2, 2011

Riding the Egyptian Stock Roller Coaster: EGPT ETF and Centamin Gold, Wild Moves

Testerday we commented on CEE, Centamin Egypt, a great company, specially for those who like to invest in gold. With the chaos in Egypt, the stock is a roller coaster:

The Egyptian ETF, EGPT, shows similar patterns:

Again, not for the feint of heart, but wild oscillations that are the dream of day traders.

Blog Archive

-

▼

2011

(510)

-

▼

February

(32)

- The Last "Great" U.S. GDP Is Now Revised Down From...

- Profitting From Oil Rising Further or Dropping: Vo...

- VISA: Your Current Debt Will Take 109 Years to Be ...

- Gold Analysis Now: Sell or Go Short; Gold in Tradi...

- BAC Shares Take Beating: New $20B Writedown, Now O...

- Tensions in Mideast: Using GLD and Yamana Gold, an...

- Home Prices in U.S. Drop To 2009's Lows, 6 Straigh...

- Spain's Banks Have 100B Euros in Problem Assets

- Roubini: G20 in Disarray, There is No Global Leade...

- G20 Currency Wars are Back: Brazil to Veto Propose...

- Mega Stock Exchanges: Brazil and China's Stock Exc...

- EU: Portugal Now Seen as Requiring a Bailout By April

- Food Prices Skyrocket And Why and How You Should I...

- Canadian's Debt Soars, Hits 150% of Income, Now Ma...

- Gold Soars as China Buys Record Gold: To Overtake ...

- Geithner: U.S. Needs To Massively Cut Corporate Ta...

- Apple's Arrogance Reaches New Levels: Subscription...

- Gold is Lifting Off This Morning

- U.K.'s Inflation Jumps to 4.0%: Twice the Target

- Forget Bernanke: MIT Says Online Inflation Jumps i...

- U.S. Interests Paid on Its Debt to Triple, to $554B

- China Invades Africa; 10X Investments in 10 Years,...

- Egypt Volatility: Opportunity in Oil ETFs; The Top...

- Oil: Petrobras Hits New Record Gasoline Production

- Irish Banks To Require Yet Another 50B Euros in Ne...

- Natural Gas: Huge Drop in Storage But Contango Rul...

- The Silly Latest Unemployment Figures: Initial Cla...

- The U.S. Exports Food and Oil Inflation: Inflation...

- Inflation Rises Again, China Raises Interest Rates...

- Geithner: Brazilian Real Overvalued Because Of Chi...

- KRY: Crystallex's Sad Story Finally Ends. Caput

- Riding the Egyptian Stock Roller Coaster: EGPT ETF...

-

▼

February

(32)