The release of the Chigago ISM numbers this morning made the markets drop like a rock:

The news was scheduled for 9:45AM (from Barrons):

How would you like to have known this report's information before it was released to the general public? Well, apparently you can. All you need to do is pay $200 per month. This is a screen capture of their web site, (click to view an enlarged version), where they explicity state that you can get the report 3 minutes ahead of it being released:

(please click to enlarge) This is not an Ad! This is their web site!

See the site here. If you are a subscriber you will get the news 3 minutes ahead of everyone else. That's enough time to short the heck out of the market or to buy some puts:

SPY 106 puts:

What a nice profit. Feel free to send me a subscription!

When is this going to end?

Wednesday, September 30, 2009

Chigago ISM Numbers Were Released Ahead of Time to a Select Few for Huge Profits

Top Currency ETFs To Buy and To Sell

The recent near-collapse of the U.S. Dollar has caused many foreign currency ETFs to soar. Currently, several are in overbought condition. Using the successful RSI7 methodology (please see our many other posts), here are the top ETFs to buy and to sell.

Top currency ETFs to sell (RSI shown):

ICI 80.58

JYN 76.93

INR 76.82

XRU 69.45

JYF 69.35

BZF 65.53

Top currency ETFs to buy:

YCS 37.59

FXS 36.84

GBB 30.58

FXB 28.28

Here is the complete list:

(please click to enlarge)

Note: You can receive technical analysis and alerts of these currency ETFs, sent automatically to you, by entering the symbols in the Technical Trend Analysis Tool, (powered by INO).

Please do your own due dilligence.

Google Wave: A Terrific New Google Product

Google is working on a new product called Google Wave. It will be released as open source and will be open to developers to collaborate and a develop new applications and gadgets, which will likely make it quite popular. It is currently in testing.

It is a amazing collaboration tool indeed where users will share a screen (ro what they want to share) through a browser; they can type and everyone sees each character being typed, they can image, videos, applications. It integrates with all the social apps you can think of (e.g, messages are posted automatically to Twitter or Blogger - bidirectionally). It will be compatible with 3rd party applications, and it works on any browser (IE, Firefox, Safari).

For teams that need to work together in distributed locations, it will be a terrific tool.

It is also a terrific product for traders working together. Add free multiway voice and it's a killer app.

Watch the video (warning: it is 1 hour 20 minutes long)

The All Supreme Fed Appeals Order to Release Infomation: Who is the Boss?

This just coming off the wires: Fed appeals the judge's decision to release information of who received bailout money. Today was the deadline, and they did it. Is the Fed above all in the U.S.?

The Fed alleges that releasing information could cause a run on the banks. If that is their fear they seem to be admitting that the banks insolvent, althought they claim they are sound and safe. Which one is it? Technically the banks are insolvent indeed, they all are. The fed is now saying that transparency is not a good thing! Isn't full disclosure one the SEC rules? Oh, but not for the Fed.

"The Federal Reserve is appealing a judge’s order requiring the central bank to identify the financial institutions that benefited from its emergency loans, according to a lawyer representing Bloomberg LP. The central bank refused to divulge details about the companies participating in its 10 remaining lending programs, saying that doing so might set off a run by depositors. The Fed had until today to seek a reversal of the Aug. 24 decision by Manhattan Chief U.S. District Judge Loretta Preska, who ruled the Fed must release the identities, as well as disclose loan amounts and the assets put up as collateral. "

Until when will everyone in the U.S. bow to the Fed?

Using Stock Divergences To Predict Stock Movement Direction

INO has a new educational video today that explains how stock divergences are used to forecast future stock movement direction. Specifically, the video analyzes the S&P500 (SPY) over several periods in the last few months, when there were divergences occurring. Divergences are an indication of change of market direction.

Watch video.

Here is another capture:

By the way, if you are interested on their services and tools, you can get two months free by using this custom link. (I am part of their MarketClub Club and receive these videos).

Jim Cramer Badly Burned on CIT Call: Stock Crashes, Straddles in Play

CIT is down 38% on reports a deal with bondholders will wipe out the current common shareholders."

Another case for straddles, there seems to be a lof these recently.

Jim Cramer apparently told his viewers to buy CIT yesterday:

"Yesterday, market pundit Jim Cramer made a ridiculously awful call on embattled lender CIT (NYSE: CIT). Cramer made a call to buy CIT stock yesterday".

There are two different plays here, strangles out-of-the money 1s and 1.50s, and in-the money's 1s and 1.50s. Interestingly, they need about the same maximum move.

Another Reason That The Markets are Going Up: Quarter End Repatriation

The collapse of the U.S. Dollar will have a positive effect to most of the companies in the U.S which do significant business outside the U.S. So they will have higher revenues, and lower P/Es, in good part due the favorable exchange rate. Read between the lines when you see their statements.

In addition, those companies are taking adantage of the low dollar to bring back to the U.S. that foreign revene, causing the U.S. Dollar to lift temporarily at least, which is exactly what we saw.

Currency chaos continues though. The central bankers are all voicing their own concerns. Trichet (ECB), and Fisher (Dallas fed) yesterday paying lip service to a strong dollar, the Swiss are extremely unhappy and may act soon, the new Japanese government saying they are under huge political pressure to move away from their pro yen policies. It's all very chaotic.

---

UPDATE 9:30AM. Bloomberg reports that the Swiss have indeed acted:

"The Swiss franc declined against the euro amid speculation the central bank sold the currency to curb its advance.

The franc slid 0.5 percent to 1.5189 per euro as of 1:34 p.m. in Zurich, and fell as much as 0.6 percent earlier, the most since July 23.

“There is a very strong suspicion that they are intervening via a Swiss supra-national,” said Sebastien Galy, a senior currency strategist at BNP Paribas SA in New York. "

Top Stocks To Buy and Sell in Latin America (ADRs)

I track all Latin-American ADRs on this site.

Here are the top ADRs to buy and sell based on the RSI7 methodlogy. Note that this methodology has even quite succesful (results).

At the moment, there are zero ADRs which are undervalued, and there are 12 which are overvalued, out of the 76 tracked. So beware the market conditions.

Top to buy (price and RSI7 shown):

None of these are actual buys, but they are the top to buy.

TMX $17.34 35.19

SIM $7.80 36.37

RC $7.00 37.96

TII $13.64 39.62

Top to sell:

EDN $7.60 89.44

SAN $57.94 88.71

CIB $42.44 86.68

TGS $2.95 80.54

MELI $38.93 79.64

TNE $19.26 74.33

NETC $11.31 72.21

CBD $55.10 71.57

PVD $34.92 71.21

SAB $19.44 70.84

BCH $48.33 70.62

BAK $12.70 70.01

EDN is an electric utility in Argentina. SAN is Banco Santander in Chile (financial). TGS is anatural gas utility in Argentina. MELI is an online services provider in Argentina as well.

Note: You may receive technical analysis and alerts of these ETFs, sent automatically to you by entering the symbols in the Technical Trend Analysis Tool, (powered by INO).

Please do your own due dilligence.

Sugar Hits All-Time High

Concerns about rainy weather in Brazil have pushed the price of sugar to an all-time high.

Investors have an easy way to buy sugar by using the IPath sugar ETF SGG.

Track live prices here.

A Political-Economic Oligarchy Has Taken Over the U.S.

A couple of days ago we posted an article about India, which discussed the risks of that country becoming an oligarchic capitalism. It turns out that the Centre for Research on Globalization, a Montreal-based independent organization, suggests that the U.S. has been taken over by a political economic oligarchy, which is not much different from an oligarchic capitalistic system. Read the full article here. Summary and excerpts below:

“This oligarchy has institutionalized a body of law that protects businesses at the expense of not only the common people but the nation itself. Businessmen have no loyalties,” claimed John Kozy, retired former professor and freelance writer, in a recent column.“The current bailout policies of both the Federal Reserve and the Treasury make use of it,” said Kozy. “Again companies are being saved at the expense of the American people. America’s civil courts are notorious for favoring corporate defendants when sued by injured plaintiffs. Corporate profiteering is not only tolerated, it is often encouraged.”

The article discusses how bankruptcy law protects the business and not some affected parties that really should be protected because they should have had no risk: employees.

"This rational clearly implies that the preservation of companies is more important than the preservation of people. The claims of workers for unpaid wages have often been dismissed as have their contracts for benefits. But there is an essential difference between a business that lends money or delivers products or services to another company and the employees who work for it. Business is an activity that supposedly involves risk. Employment is not. Neither is unknowingly buying a defective product. Workers and consumers do not extend credit to the companies they work for or buy products from. They are not in any normal sense of the word creditors. Yet that distinction is erased in bankruptcy proceedings which preserve companies at the public’s expense".

"Of course, bankruptcy is not the only American practice that makes use of this principle. The current bailout policies of both the Federal Reserve and the Treasury make use of it. Again companies are being saved at the expense of the American people".

The author asks how can any of it be justified?

"How this situation could have arisen is a puzzle? Haven’t our elected officials, our justices, our legal scholars, our professors of Constitutional Law, or even our political scientists read the Constitution? Have they merely misunderstood it? Or have they simply chosen to disregard the preamble as though it had no bearing on its subsequent articles? Why have no astute lawyers brought actions on behalf of the people? Why indeed?"

"The answer is that a political-economic oligarchy has taken over the nation. This oligarchy has institutionalized a body of law that protects businesses at the expense of not only the common people but the nation itself. Businessmen have no loyalties. The Bank of International Settlements insures it, since it is not accountable to any national government".

"To argue that the United States of America is a failed state is not difficult. A nation that has the highest documented prison population in the world can hardly be described as domestically tranquil. A nation whose top one percent of the people have 46 percent of the wealth cannot by any stretch of the imagination be said to be enjoying general welfare (“generally true” means true for the most part with a few exceptions). A nation that spends as much on defense as the rest of the world combined and cannot control its borders, could not avert the attack on the World Trade Center, and can not win its recent major wars can not be described as providing for its common defense. How perfect the union is or whether justice usually prevails are matters of debate, and what blessings of liberty Americans enjoy that peoples in other advanced countries are denied is never stated. A nation that cannot fulfill its Constitution’s stated goals surely is a failed one. How else could failure be defined? By allowing people with no fastidious loyalty to the nation or its people to control it, by allowing them to disregard entirely the Constitution’s preamble, the nation could not avoid this failure. The prevailing economic system requires it.

Woody Guthrie sang, “This Land Is My Land, This Land Is Your Land,” but it isn’t. It was stolen a long time ago. Although it may have been “made for you and me,” people with absolutely no loyalty to this land now own it. It needs to be taken, not bought, back! America needs a new birth of freedom, it needs a government for the people, it needs a government that puts people first, but it won’t get one unless Americans come to realize just how immoral and vicious our economic system is".

One wonders whether Goldman Sachs controls this government, and other governments of the world. Most of them have GS alumni in high ranking positions.

Tuesday, September 29, 2009

Bill Gross: Deflation; Fisher: The Fed will Agressively Fight Inflation. Really?

“There has been significant flattening on the long end of the curve,” Gross said in an interview from Newport Beach, California, with Bloomberg Radio. “This reflects the re-emergence of deflationary fears. The U.S. is at the center of de-levering as opposed to accelerating growth.”

At the same time, Fed officials warned that to prevent inflation from taking off, the Federal Reserve will need to start boosting interest rates quickly and aggressively "once the economy is back on firmer footing." (AP)

Richard Fisher, president of the Federal Reserve Bank of Dallas said: "I expect that when it comes time to tighten monetary policy, my colleagues and I will move with an alacrity that, if needed, will be equal in speed and intensity" to when the Fed was slashing rates to battle the recession and the financial crisis".

Mr. Fishers's comments are just part of the campaign to boost the U.S. Dollar, this is totally expected. The Fed won't raise interest rates anytime soon. They just talk about it. Everytime they talk, the dollar goes up. Talk is cheap...

Boosting even more the deflation case, rents are falling everywhere. See the article by Jonathan Lansner.

SQNM, Sequenom Crashes: How to Profit

SQNM, the vendor of medical-diagnostic tests said that flawed research would cause it to throw away years of work. The company "failed to provide adequate protocols and controls" of results for its prenatal Down syndrome blood test.

Today the company fired CEO, and the head of research and development. The chief financial officer, and another officer resigned. An incredible situation which makes the company likely to fail. Whether it fails or recovers, here are the straddles to profit from either situation:

You may receive technical analysis and alerts on SQNM, sent automatically to you by entering the symbols in the Technical Trend Analysis Tool, (powered by INO).

Please do your own due dilligence.

Top 10 Occupations Looking for Employees

Among the data published by the Conference Board is the top 10 occupations in September with online advertised vacancies. There is a significant difference in the number of unemployed seeking positions in different occupations. Some jobs even have more openings than job seekers by a factor of 3 to 1.

Here are the top 10 with most help wanted ads:

- Healthcare Practitioners and technical

- Management

- Computer and Mathematical Science.

- Sales

- Office and admin

- Business and financial operations

- Architecture and engineering

- Healthcare support

- Arts, design, entertainment, sports, media

- Installation, maintenance, repair

In Sales and Related Occupations, there were 4.1 people seeking jobs in this field for every online advertised vacancy and there were 4.8 unemployed looking for work in Office and Administrative Support positions for every advertised opening. Accordingly, the top hourly wage was for management ($48), and computers and Math sciences, $35.82.

On the other hand, there were 3 times more jobs offers than people looking for jobs in Healtcare, and nearly 2:1 in computer and mathematical sciences. Table:

(please click to enlarge)

Number of Online Help Wanted Ads Declines by 108,000: Bad for Non-Farm Payroll Report This Friday

The Conference Board just released its monthly report on the number of online help wanted ads. The numbers are not good, falling by 101,800 in September.

This could be an indication that this Friday’s non-farm payrolls report may dissapoint, so be careful.

Highlights:

- September losses partially offset the larger August gains in job demand

Trends for largest states remain unchanged

- Outlook: National trend slightly positive since April with increases in job demand averaging 40,000/month

- Occupations: Healthcare professions continue to be in increasing demand

- Labor demand continues to remain well below year-ago levels for most occupations

Historical chart:

(please click to enlarge)

Online advertised vacancies declined by 101,800 to 3,363,000 in September, according to The Conference Board Help-Wanted OnLine Data Series.

September losses partially offset the larger August gains (+169,000), leaving labor demand up by 67,000 over the past two months. Since the low point in April 2009, labor demand is up by 201,000, showing a modest upward trend following a five-month period of steep losses.

"While the trend has been modestly upward and averaged 40,000 per month over the last five months, the labor market continues to have a hard time gaining momentum," said Gad Levanon, Senior Economist at The Conference Board. "The Conference Board Employment Trends Index, which has been basically flat for three straight months, also helps highlight the difficulty the labor market is facing. With a growing consensus of a weak recovery, businesses seem to be slow to boost advertising for vacant or new positions."

UNG Cannot Find Buyers for New Shares.

BNN has just reported rumous that after the hoopla, UNG could not find any buyers for its new shares. Details coming.

UNG resumed issung new shares yesterday. It had not been able to issue new creation baskets since June.

At the time of the SEC filing, UNG's management had said "UNG's management cannot predict what impact, if any, the resumption of creation activity will have on the price of the UNG units on NYSE Arca."

Well, no buyers!

Today's Top 40 Movers: ASTC +185%, LEE +51%, SQNM -35%, TIV -21%

Here are today's top movers (up and down), as of 11:30AM:

You may receive technical analysis and alerts of these ETFs, sent automatically to you by entering the symbols in the Technical Trend Analysis Tool, (powered by INO).

FDIC is Asking for a Bailout

Blooomberg reports that the FDIC, Federal Deposit Insurance Corp., today voted unanimously to have lenders prepay fees through 2012, raising about $45 billion. What a bizarre mechanism. In effect, bake wil be bailout the FDIC out.

"FDIC is seeking to replenish deposit reserves as banks fail at the fastest pace in 17 years,"

"Lenders would prepay FDIC premiums for the fourth quarter and next three years on Dec. 30, to replenish the deposit insurance funds that staff estimated will have a negative balance at the end of this quarter, the agency said. "

The cost of bank failures has been raised to $100 billion through 2013.

The Future of the Dollar Explained, Why and How it Will Lose 50% of its Value

Jim Rickards, director of market intelligence for Omnis explains on CNBC that the fact that Fed Governor Kevin M. Warsh (the governor who acknowledged that the Fed is concealing records of its gold swap arrangements) wrote a piece on the Wall St. Journal on Friday, the same day the G-20 meeting, is no coincidence. The piece was entitled "The Fed's Job is Only Half Over".

Warsh wrote: "Equally, there are uncertainties about the performance of the monetary transmission mechanism and the operation of the Federal Reserve's unconventional policy tools.""For example, the level of asset prices and associated risk premiums, and gauging their trend and durability, will demand careful assessment.

Mr. Pickards takes the above "assets" to mean gold.

Mr. Pickard sees a quiet 'under the table'-like 50% devaluation of the U.S. Dollar versus a new "currency" controlled by the IMF.

Rickards understand Warsh's essay to mean that the Fed will regulating the gold price closely even as the Fed needs to devalue the dollar by about half over the next 14 years (he says about 4% per year) to restore solvency to the United States.

Rickards says the Fed's purpose is to inflate the dollar to prop up the banks; claims that the Fed's purpose is to achieve "price stability" are manifestly nonsense. Central banks plan to turn the IMF's SDRs' (Special Drawing Rights) into the new world reserve currency. In other words, a new round of money printing to create some stability during the dollar's steady but gradual and controlled devaluation.Rickards said gold will go to $2,000 but "When you own gold you're fighting every central bank in the world."

How to Invest in Gold: Physical Gold vs ETFs, Miners

Talk about gold is everywhere. Every financial news TV channel, every newspaper,it seems that every blog, talks about owning gold. That is usually a bad sign for the short term. Nevertheless, this article takes a look at different ways of owning gold, from paper ETFs, to physical gold, and miners.

Physical possession of actual gold (coins, bars) is the best protection against confiscation. This means your own physical ownership, hidden under the matters, or buried in your backyard, or in a safe in a bank. In a bank it can still be confiscated though, as it happened in the 1930s.

GOLD COINS:

Banks and dealers sell them. ScotiaBank is a popular bank, but I know you an get them at RBC, and likely any other Canadian bank.

Dealers

There are many dealers around the world. In Canada Scotia Bank has just launched (today) a new online service. ScotiaMocatta is their precious metals dealer, one of the largest in the world. You can buy up to $6k online and the coins are delivered to your door. Site.

Canadian Maple Leafs

Canadian coins are produced by the Canadian Mint, they are the Maple Leafs. You can buy gold, silver, and platinum/palladium coins. First minted in 1979, the Canadian Maple Leaf is a pure .9999 (24 Karat) gold coin with no additional alloys added due to a special minting process by the Royal Canadian Mint. They come in various sizes:

-1 Troy Ounce

-1/2 Troy Ounce

-1/4 Troy Ounce

-1/10 Troy Ounce

-1/20 Troy Ounce

Some collector coins even have coins with a $1M face value.

You can view some current prices here (currently around $1030.00 for 1 ounce, add around 3% commission).

American Gold Eagle coins.

You can see prices from dealers here. (I have not use these servcies).

Kruggerrands:

These are South African coins. View prices.

Australian Gold Nugget

The Perth Mint in Australia makes and sells the Australian Gold Nugget can also buy collector coins with kangaroos and koalas depicted in the them.

Perth Mint bars come with a serial number, the weight, the purity and the Perth Mint stamp. From the Perth Mint you can buy allocated and unallocated gold. The former being an allocated bar(s) for which you pay a storage cost and the latter is part of the mints guaranteed inventory for which you pay no holding costs. You can also buy a Call Warrant on the ASX (ASX:ZAUWBA) which "entitles you to acquire one hundredth of a troy ounce of fine gold on or before the Expiry Date of 31 December 2013 and may be exercised by you at any time before the Expiry Date."

GOLD CERTIFICATES:

Banks sell them, for example, Scotiabank. These are certificates for possession of gold that you can keep your self or in a safe. They are meant to be interchangeable with physical gold. They have obvious advantages over physical gold in terms of safety, but the actual thing is not in your possession. Please see this comment about someone who had silver cetificates for many years, paid storage fees al these years, went to the bank to get his silver, and was told there was none.

BullionVault:

A Swiss version which allows you to own allocated gold in a professional bullion vault with daily 3rd party audits. Another expert says that you cannot take delivery of your bullion at Bullionvault unless there is a "special" circumstance like.

ETFs.

There are many ETFs that track the price of gold.

GLD:

The Spiders Gold Shares is the biggest and best known ETF. It says it currently owns 1,094 tons of gold. It has always been subject to many conspiracy theories and suspicions. Many believe it is not really backed by physical gold, they do not have or share physical bar numbers. In the event of financial difficulties, each shareholder appears to be an unsecured creditor.

GLD appears to own real gold bars in a real vault but they belong to the ETF Trust, not to shareholders, who are creditors. The management fee for owning GLD shares is 0.4% per year. A gold expert says that a "real" bar list would list every serial number of each bar. Instead GLD just list the bars #1, #2, #3, #4 ... etc.

IAU, and IGT:

iShares COMEX Gold Trust is a trust whose purpose is to own gold transferred to the Trust in exchange for shares issued by the Trust. The objective of the Trust is for the value of its shares to reflect, at any given time, the price of gold owned by the Trust at that time, less the Trust’s expenses and liabilities. IAU trades in the U.S, IGT in Canada.

CEF.UN:

This Canadian ETF seems solid and backed by physical gold and silver. The Company invests virtually all of its assets in long-term holdings of unencumbered, allocated and segregated gold and silver bullion. The Company holds at least 90% of its net assets in gold and silver bullion, primarily in bar form. The Central Fund of Canada says that its bullion holdings and bank vault security are inspected twice annually by directors and/or officers of Central Fund. "On every occasion, inspections are required to be performed in the presence of both Central Fund's external auditors and bank personnel".

Although CEF can be bought on the AMEX (symbol CEF), it is ultimately a Canadian-dollar based stock. Investors in the U.S. should take into consuideration the exchange rate between the U.S. Dollar and the Canadian dollar. This could actually work in your favor, if the U.S. dollar collapses further.

GTU.UN:

Another Canadian ETF. Gold is stored in segregated safekeeping in the treasury vaults of the Canadian Imperial Bank of Commerce. Auditors perform an annual physical bullion inspection. It can be bought on the Amex (symbol GTU). Exchange rate considerations apply.

This chart shows the performance of GTU vs GTU.UN year-to-date. It clearly shows the implications of using different currencies. In the end, however, if a U.S.-based investor had bought in Canadian dollar, the GTU.UN version would be 10-12% higher since the US dollar lost the same amount.

ETNs:

Deutsche Bank has 4 gold ETNs:

- DB Gold (NYSE: DGL) (gold ETF)

- DB Gold Double Long (NYSE: DGP) (long leveraged gold ETN)

- DB Gold Short (NYSE: DGZ) (short gold ETN)

- DB Gold Double Short (NYSE: DZZ) (short leveraged gold ETN)

Other ETFs and ETNs:

COMPARISONS

CEF vs GTU:

This chart compares both ETFs on YTD basis. Remember that CEF also has silver, and silver has had a stellar year.

HBU.to:

This is a 2X gold bullion ETF, a leveraged Canadian ETF not backed by physical gold. For day traders or gamblers, or if you believe gold will rise without volatility.

MINERS

Producers:

Producing miners are a great way to obtain leveraged exposure to gold. Look for companies that have no debt issues. There are many, my favorites: Goldcorp, Kinross, Yamana. I'd stay away from Barrick. In silver, Silver Wheaton has a great royalty model.

Juniors:

Exploring companies are lottery tickets. The conservative investor should stay away from them. However, juniors that are already producing and have no debt are potentially good.

MINING INDEX ETFs:

GDX is the Miner ETF in the U.S. XGD.to is the Canadian version. They correspond to baskets of companies.

GLD vs GDX chart:

Finally, we compare GLD with HBU.UN. GLD is in U.S Dollars, HBU is Canadian and leveraged 2X:

An American investor who had bought HBU at the beginning of the year would add another 10% or so on top.

Notes:

Some notes from others that I found useful:

"Cost/ premium: GLD tracks spot price closely. CEF and GTU trade at some premiums to net asset value. Bullion Vault also sound like they have low transaction costs. Perth Mint charges 3.8% for a kilo bar and 9.1% for a 1 oz coin. Allocated storage fees can run 3%. Your local coin dealers premium is usually negotiable- currently 5-10% Storage/liquidity: All storage methods have risks. GLD, CEF or GTU can be sold with a mouse click. Perth Mint gold can be sold at any time with a choice of redeemable currencies. Coins in your lock box at the bank can be viewed by government authorities without a warrant or your knowledge at any time. Gold in the home is subject to possible loss due to crime, fire or lost if you forget where you stored it. Selling your physical gold may be difficult due to the vagaries of a crisis environment which would dictate the need to liquidate gold or coin dealers. Tax consequences: The ETF's probably have less tax liability at the moment however rules are likely to change in the future. Physical gold could be bartered or sold in small amounts in behind the door transactions. In a severe crisis, energy and ammo may be more valuable than gold, but gold should be exchangeable for the things you need to survive".

ETFs to Profit From Options Without Buying or Selling Options

Writing options is a powerful way to improve ROIs and generate income. In particular, options writing (selling options) is very profitable as it is a well-known fact that the vast majority of options expires worthless. So whoever sells the options ends up pocketing the premium.

In general, only investors with deep pockets can sell options. In other cases, options writing is not allowed in registered retirements accounts. Therefore, the majority of small and mom & pop investors cannot take advantage of this protitable strategy .

Powershares has a couple of ETFs that are based on options writing strategy. In essence, the ETF itself bys shares and writes Call options to improve profits ("covered calls"). This is a really interesting idea. Let's see how well they perform.

PQBW: PowerShares NASDAQ-100 BuyWrite Portfolio

This ETF tracks the Nasdaq-100, whose equivalent ETF (without using options) is the QQQQ. It seeks investment results that correspond to the price and yield of the CBOE NASDAQ-100 BuyWrite Index. It measures the returns of a theoretical portfolio of NASDAQ-100 Index stocks combined with NASDAQ-100 Index call options, which are systematically written against the portfolio. The expense ratio is 0.75%.

The 3-month chart shows well how the fund works. During the last 3 months the markets have been in an upswing. Because the PQBW writes options, its shares are called away whenever a certain price (whichever strikes were sold) target is reached, thus capping its profits.

The 1-year chart shows very well what happens in opposite market conditions. When stocks decline, the PQBW performs better as selling options will reduce the cost basis, either by generating income from Call sales.

PBP: PowerShares S&P 500 BuyWrite Portfolio

This ETF tracks the SPX (S&P500). Its equivalent is SPY. It seeks investment results that correspond to the CBOE S&P 500 BuyWrite Index (BXM). The Index is calculated by the CBOE and measures total returns of a theoretical portfolio, including the S&P 500 Index stocks, on which S&P 500 Index call options are systematically written. Its expense ratio is also 0.75%. This strategy consists of holding a portfolio indexed to the S&P 500 and selling a succession of written options, each with an exercise price at or above the prevailing price level of the S&P 500. CBOE index site.

From the CBOE site we see that the BXM Index was developed by the CBOE in cooperation with Standard & Poor's. The CBOE commissioned Professor Robert Whaley to compile and analyze relevant data from the time period from June 1988 through December 2001. The BXM is a passive total return index based on "(1) buying an S&P 500 stock index portfolio, and (2) "writing" (or selling) the near-term S&P 500 Index covered call option, generally on the third Friday of each month". The SPX call written will have about one month remaining to expiration, with an exercise price just above the prevailing index level (i.e., slightly out of the money). The SPX call is held until expiration and cash settled, at which time a new one-month, near-the-money call is written."

The 3-month chart shows the same behavior as PQBW-QQQQ. We drew circles around periods in which the market was declining and when it was rising:

Again, the ETF outperforms SPY when the markets goes down, and underperforms when it goes up.

Comments

Overall the performance is dissapointing in that it should be able to generate bigger profits by selling options. As it is, these ETFs still go down when the market goes down, and they profit less when the market goes up. This is not that atttractive. Perhaps it is the particular strike prices that are being sold that are not optimal. Perhaps it is the way this market has been working itself is not allowing the strategy to perform better.

There are clearly many alternatives to the approach they are taking with selling options at strikes at 1-month at or slightly above the current stock price. It is possible for such an strategy to ourperform in both cases when the market goes up and down. Here is an opportunity waiting for a financial institution to offer a better alternative if they really wanted to offer the benefit of options writing in a ETF product.

To receive technical analysis and alerts of these ETFs, sent automatically to you by entering the symbols in the Technical Trend Analysis Tool, (powered by INO).

The Top 50 Safest Banks in the World

Global Finance magazine released a ranking of the top 50 global banks in terms of safety. This list has been released for 18 years.

Says GM: "Those banks that kept an iron grip on their risk exposure before the financial crisis blew up have consistently topped the table and maintain their standing among the top echelon in this year’s ranking."

The list was compiled based on long-term credit ratings, total assets of the 500 largest banks around the world; ratings from Moody’s, Standard & Poor’s and Fitch were used.

Canada is the country with most banks on the list (6), followed by Germany, France and the U.S (5).

Here they are:

1 KfW (Germany

2 Caisse des Depots et Consignations (CDC) (France)

3 Bank Nederlands Gemeenten (BNG) (Netherlands)

4 Landwirtschaftliche Rentenbank (Germany)

5 Zuercher Kantonalbank (Switzerland)

6 Rabobank Group (Netherlands)

7 Landeskreditbank Baden-Wuerttemberg-Foerderbank (Germany)

8 NRW. Bank (Germany)

9 BNP Paribas (France)

10 Royal Bank of Canada (Canada)

11 National Australia Bank (Australia)

12 Commonwealth Bank of Australia (Australia)

13 Banco Santander (Spain)

14 Toronto-Dominion Bank (Canada)

15 Australia & New Zealand Banking Group (Australia)

16 Westpac Banking Corporation (Australia)

17 ASB Bank Limited (New Zealand)

18 HSBC Holdings plc (United Kingdom)

19 Credit Agricole S.A. (France)

20 Banco Bilbao Vizcaya Argentaria (BBVA) (Spain)

21 Nordea Bank AB (publ) (Sweden)

22 Scotiabank (Canada)

23 Svenska Handelsbanken (Sweden)

24 DBS Bank (Singapore)

25 Banco Espanol de Credito S.A. (Banesto) (Spain)

26 Caisse Centrale Desjardins (Canada)

27 Pohjola Bank (Finland)

28 Deutsche Bank AG (Germany)

29 Intesa Sanpaolo (Italy)

30 Caja de Ahorros y Pensiones de Barcelona (la Caixa) (Spain)

31 Bank of Montreal (Canada)

32 The Bank of New York Mellon Corporation (United States)

33 DnB NOR Bank (Norway)

34 Caixa Geral de Depositos (Portugal)

35 United Overseas Bank (Singapore)

36 Oversea-Chinese Banking Corp. (Singapore)

37 CIBC (Canada)

38 National Bank Of Kuwait (Kuwai)

39 J.P. Morgan Chase & Co. (United States)

40 UBS AG (Switzerland)

41 Societe Generale (SG) (France)

42 Wells Fargo & Co. (United States)

43 Credit Suisse Group (Switzerland)

44 Banque Federative du Credit Mutuel (BFCM) (France)

45 Credit Industriel et Commercial (CIC) (France)

46 Nationwide Building Society (United Kingdom)

47 U.S. Bancorp (United States)

48 Shizuoka Bank (Japan)

49 Northern Trust Corporation (United States)

50 National Bank of Abu Dhabi (UAE)

Investing in India: At Risk of Oligarchic Capitalism

For those interested in investing in India, The Epoch Times had an article on India this weekend. It says that a report from the Asian Development Bank warns that India is at risk of shifting from capitalism to an oligarchic system where a small group of very wealthy people control the economy, and thus politics, and thus the country.

Read the ADB's outlook for India.

Chart of India's GDP (Feb 2009):

“There is a risk that India will evolve toward a condition of oligarchic capitalism, in which the market and political power of major corporations will become a drag on long-term growth and a source of distortion in policy design,” said researchers in a recent report titled “India 2039” published by the ADB.

"There is now a growing risk that parts of the corporate sector will wield excessive influence over the state,” "The continuation of a combination of weak and ineffective state and more powerful and creative big business houses will inevitably lead to large-scale misuse of market power and invite a massive backlash against a market-based economic system,”

"India's government urgently needs to develop the fundaments of a viable, competitive, regulated market and take control over its vast resources. If not, India's large corporations could slowly whittle away the country’s democratic market environment.The “concentration of wealth and influence could be a hidden time bomb under India’s social fabric ... India urgently needs more self-regulation by industry as well as strongerand more vigilant independent state organs to ensure more ethical and transparent behavior by the private sector,”.

Indian ETFs

1. PowerShares India Portfolio (PIN): This ETF tracks the Indus India Index which is designed to replicate the Indian equity markets as a whole (top 50 Indian stocks selected from the largest companies listed on two major Indian exchanges)

2. Wisdom Tree India Earnings Fund (EPI): This ETFs invests in Indian companies that are listed on a major stock exchange in India and meet the following criteria:

- at least $5 million in earnings in the last fiscal year.

- market capitalization of at least $200 million.

- average daily dollar volume of at least $200,000 for each of the preceding six monthstraded at - traded at least 250,000 shares per month for each of the six months prior to the Index measurement date.

- P/E greater than 2

3.iPath MSCI India Index ETN (INP): This is an ETN which tracks the MSCI Total Return Index, which is an index that represents approximately 85% of the free-float-adjusted market capitalization of equity securities by industry group within

4.First Trust ISE Chindia Index Fund (FNI): This ETF invests in the ADRs, ADS or stocks of companies both in India and China. It has 50 holdings.

You will notice that the performance of all four is nearly identical.:

(please click to enlarge)

Please note that you may receive technical analysis and alerts of these ETFs, sent automatically to you by entering the symbols in the Technical Trend Analysis Tool, (powered by INO).

Production Lines and Factories Moving to Brazil

Brazilian newspaper O Estado de Sao Paulo reports that the current economic crisis has sparked a global trend towards relocating production lines or even entire factories from abroad to Brazil. The Brazilian Ministry of Development, Industry and Foreign Trade said yesterday that about 50 companies have requested government permission to bring their machines to the country.

Applications for imports were made by various sectors such as food, textile, chemical, furniture and mining. The origin of the production lines varies: United States, Canada, France, Portugal, Germany, United Kingdom.

Many of the requests came from manufacturers of auto parts, a sector in which the performance of the Brazilian market is much better than the rest of the world.

With the drop in demand in the U.S. and Europe, multinational companies were left with excess capacity there. The crisis also led to the failure of companies, creating opportunities for Brazilian companies to buy machines used abroad for a fraction of the price of new.

"It is better to produce here and export to the U.S.. And with the crisis, part of the production that went to American customers is now in Brazil," said the vice president of industrial Coteminas, Pedro Bastos. Among the advantages of bringing the production to Brazil are the quality of cotton, the lower cost of labor, and proximity to the controlling group. He says the crisis has made the transfers more complicated, because it meant loss of jobs for Americans.

The list of companies that are betting on Brazil included multinationals like Nestle and Motorola. According to the vice president, mobility, Eduardo Stefano, tax incentives and high import costs were the reasons to produce locally. He also said that Brazil is lacking in broadband technology. A

Nestlé brought from Mexico a complete line for manufacturing and bottling of mineral water.

The "import" of machinery and factories is controversial. The investment is always welcome, because it increases production and create jobs. But by allowing the entry of used machines, the government may discourage internal capital investments. The transfer of production lines has led to complaints by manufacturers of machinery. "We run the risk of scrapping the Brazilian industry. The sector of capital goods is not out of the crisis," said Nelson Deduque, director of the foreign market of the Brazilian Machinery Manufacturers Association (Abimaq).

The companies argue that import a production line used can reduce up to 80% the cost of investment. This allows companies to medium and small size also increase production.

"The potential of the Brazilian market is large, but to be competitive you have to run here. Moreover, the impact of the crisis was most violent in Europe," said the owner of the Portuguese furniture maker Iduna.

Monday, September 28, 2009

Higher Earnings Due to the Lower U.S.Dollar: Stocks May Climb Higher or Drop; Profit Either Way

Although the markets are overextended and fundamentals do not support further rises, and even higher P/Es, there are a few possibilities for stocks to continue climbing higher:

1. Companies in the U.S. that have foreign earnings may report very high earnings due to the collapse of the U.S. dollar

2. Banks could report very high earnings due to the Fed's policy of zero interest rates. The banks borrow for free, yet they are still charging much higher rates. Got XLF?

3. Trillions of dollars are sitting on the sidelines, owned by investors who ran away from the stock markets during the crisis. Once Q3 earnings start to appear, these investors may come back, further fuelling stock rallies.

4. The Fed and the U.S. government need stocks to rise so that people make money - and extend the tax base, capping the collapse in tax revenues.

The S&P500 is poised for its biggest fourth-quarter rally in a decade according to Byron Wien, vice chairman of Blackstone Group LP. The pumping is on.

So, throwing fundamentals out the window, stocks may continue to climb. However, if they keep climbing, RSIs will again reach nose bleed levels, and October is also a notorious month for volatility - and stock market crashes.

Anything can happen. It does not matter. Investors can potentially profit fro this situation with straddles. Here are some for October, November, and December, for our favorite IWM (Russel 2000), as well as XLF (Financials) and SPY (S&P 500). They were computed with the StraddlesCalc V2 tool. The tables show optimum position sizing for $1k invested in each branch (use multiples of these for higher investments), and the maximum moves required to achieve profitability. Actual moves may be lower depending on time to expiry. All are highly liquid.

IWM:

XLF:

SPY:

To receive technical analysis and alerts on these ETFs, enter the symbols in the Technical Trend Analysis Tool, (powered by INO).

As always, options are very dangerous. Please do your own due dilligence.

Which Central Banks are Worried About Their Currencies? Not the Fed!

Kathy Liem of GFT Forex says that the Fed is not worried. However, other central bankers across the globe are starting to get"fidgety" while "traders and investors are on the lookout for intervention".

She has some very good points, many of which we have discussed here, but some are new. A stronger currency has the similar effect on an economy as a rate hike but the difference is that central banks control the timing - not foreign exchange fluctuations. She says that a stronger currency can wipe out months of work.

Although the U.S. dollar has rebounded (as per our psots on the G20 meeting), "we may not see a long term bottom in the greenback unless one of the major central banks step in and either verbally or physically intervene in their currencies".

So which Central Banks Are Worried About their Currencies?

Switzerland, U.K, and Canada are very worried. Not worried are Australia, and amazingly, the U.S.

Canada

Marc Carney, Bank of Canada governor, just said so today in Victoria, B.C. He reiterated his statements that he may have to do quantitative easing to drop the value of the Canadian dollar.

U.S.A.

The U.S is very happy to lower the dollar in order to export more, and import inflation to counteract the current deflation threats. Ms. Liem says "the Fed is basking in dollar weakness" as the plunge in commodity prices has reduced inflation pressures, as well as making foreign earnings of U.S. multinational corporations appear larger, which could cause great earnings in the third quarter".

There is your stock market rally - at least until the end of Q3 2009.

She says that statements by the Fed that they support a strong currency, are nothing more than lip service.

Australia.

Australia has benefitted from the U.S. recovery, stimulus in China and the previous rise in commodity prices. "Based upon this comments from Governor Stevens, the RBA should be the first major central bank to raise interest rates".

U.K.

United Kingdom – The Bank of England is the "probably the most dovish". The BoE has "dollar envy". They love a weak currency.

Switzerland

Swiss National Bank is the most worried about their currency as in recent weeks, the Franc has appreciated significantly against the U.S. dollar. Last week, the SNB said that further franc strength is "unacceptable".

Insider Buying of Xerox Puts, Large Volumes Bought in August

Please take a look at the 3-month charts of Xerox October 8 and 9 puts.

9 puts:

(please clisk to enlarge images)

Notice the large unusual volume of puts bought, particularly at the end of August for $0.80 to $0.90. Today these puts are trading at $1.70.

8 puts:

Similarly, notice the high volume of puts bought in and around August, for between $0.30 and $0.04. Today they trade around $0.75.

How to Profit From the Xerox Crash

Xerox (XRX) is down 18% today on news it is acquiring a computer services company. The printer and copier maker will pay $6.4B, or $63.11 for each ACS share, roughly a 34% premium to Friday's closing price. The move is seen as highly dillituve, out of focus, and basically another blunder for the company.

These situations are ideal for our favorite stategy, straddles. If the move was overdone, the stock will recover. If not, the stock will continue crashing. Potential profits either way, regardless of direction.

Here they are, calculated with our StraddlesCalc V2 tool. We show both an 8-8 straddle and 8-7 strangle.

Please do your own due dilligence.

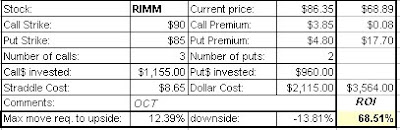

Research in Demotion: RIMM Continues to Slide, Straddles +68%

Research in Motion, RIMM, continues to slide today, bringing the profits of the straddles we posted 5 days ago to over 68%:

Central Bankers Report Card: Bernanke Ranked a 'C'

Global Finance Magazine today released its annual report card on how well the central bankers have performed in 2009. This report has been published since 1994 and it considers:

- inflation control

- economic growth goals

- currency stability

- interest rate management.

Ben Bernanke received a "C". The worst bankers received a "C-" (Norway, Russia, Sweden).

The top bankers were trichet from the European Union, the Czech Republic, Austrlia, Malaysia, South Korea and Taiwan, with an 'A".

Here is the list covering the Americas, Europe, and Asia:

(click to enlarge)

The Current U.S.: a Can Do Nation, or a Can't Do Nation?

The Financial Post had an article last Friday titled "The Call on America Inc., a Can't do Nation".

The author describes a young man he saw in Waikiki carrying a sign "Homeless. Please help.". He sported thousands of dollars worth of tattoos, smoked a cigarette and chatted on his cell. The authors wonders what this might represent in the larger picture, what might be the connection between this young man and the United States of America. He goes on:

"...that well-fed tattooee could still be America right now: Living the life, bumming along, confident that the handouts will keep coming, that the smokes will be there for the smoking, that the cellphone calls will keep coming from homeless friends."

"You've likely already guessed that I believe the United States is not a buy-and-hold proposition for the long haul, that a combination of political folly, financial recklessness, foreign adventurism and general carelessness have put the country too far into the hole for it to climb out and back to the form of, say, the 1990s."

"The last time United States faced such a task, it took the Second World War to lift it out of a seemingly endless economic morass, to galvanize the country and set the stage for the great post-war expansion that helped define the 20th century as America's".

We sure hope these wars will not happen and will not be needed again.

I disagree with the author on the long term. No, the U.S is a great nation with huge resources and great people. Yes, it is in a huge deep and scary hole. However, it can and should be able to have a great future. If only the big bankers were controlling it for short term profit? Certainly one of its biggest problems.

It is not over!

Bernanke Says "We Did It", Federal Reserve Caused the Great Depression

There have been recent reports about Ben Bernanke admitting that the Fed caused the Great Depression. What is less known, is that this can be found in a document from the Federal Reserve itself, found on its own site. It was written by Ben Bernanke as a congratulatory message for Milton Friedman.

"Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again."

The letter/article was in "Remarks by Governor Ben S. Bernanke At the Conference to Honor Milton Friedman", University of Chicago, Chicago, Illinois, November 8, 2002

It is interesting that the Federal Reserve System had been set up exactly to prevent what actually happened at the time. It was set up to avoid scenarios in which baks would have to close down and to avoid a banking crisis. The Fed seems indeed to be a source of many rather large problems. It created a bubble between 2001-2007 through very low low interest rates. No wonder many are calling to audit the fed, or even to abolish it.

The level of debt in the U.S. will never be repaid. Some say this will cause the dollar to continue plunging, and gold to skyrocket. However, things are not so simple. The US dollar plunging will cause other large problems to other countries whose currencies will appreciate (and thus will hurt their exports). Other large countries have also been increasing their debts, so they are really in the same boat. This includes China, where things are not rosy as you may read. Please take a look at these charts.

It is a well known fact that Ben Bernanke has been a great studier of the Great Depression and has written considerably on the subject. The policies he is putting in place today may be designed to avoid a repeat of that event. Bernanke believes that rates were too high (policy too tight) during the Great Depression and that the fact that the fed was defending the strength of the Dollar greatly contributed to making the crisis worse. Mr. Bernanke believed that the more a country devalued its money the quicker it recovered.

Those are scary thoughts for the U.S. Dollar. However things are quite diferent today. There is no more gold standard, so it is difficult to say against what the dollar would be devalued as all other large countries have been printing mkoney and increasing their debts. The gold market is relatively small ($1.4T), controlled and manipulated by a few.

Real goods which will always be necessary (food) are definitely a good place to protect money. This is why countries with resources, particularly emerging countries, are so important. More on this later.

Protect Your Money: How to Invest in Latin America

With the collapse of the U.S. Dollar investors are wise to diversify into other regions of the world. As readers here now, I maintain a list of Brazilian ADRS at http://nexalogic.com/brazil.html ADRs are basically foreign stocks that are tarded in the NYSE. So you can buy these foreign companies just as if they were American stocks.

I have now created a complete list of Latin-American ADRs as well, covering all available companies in Latin America that trade in the NYSE. You may track them live here. The site also shows daily performance, and YTD (year-to-date) performance. Enjoy. Remaining fields in the list will be populated as my time permits! Additions welcome.

Here are just the symbols of the companies covered:

BRAZIL

ABV ELP SID

ARA ERJ TAM

BAK GFA TNE

BBD GGB TSP

BRP GOL TSU

BTM ITU UBB

CBD NETC UGP

CIG PBR VALE

CPL PDA VCP

CZZ PZE VIV

EBR SBS

CHILE

AKO

BCA

BCH

ENI

LFL

PVD

SAN

SQM

VCO

ARGENTINA

APSA NTL

BFR PZE

BMA TAR

CRESY TEO

EDN TEO

GGAL TGS

MELI YPF

MGS

PERU

BAP

BVN

COLOMBIA

CIB

PANAMA

BLX

WG

MEXICO

AMX OMAB

ASR PAC

CX RC

FMX SAB

GMK SIM

HXM TII

IBA TMM

KOF TMX

MXT TV

You may also receive technical analysis and alerts of these ADRs, sent automatically to you by entering the symbols in the Technical Trend Analysis Tool, (powered by INO).

Large Number of SPY Puts: Average ROI of +55

Last weekend we reported the large number of SPY puts bought on Friday September 18:

The average ROI on these puts has been approximately +58% so far. SPY at the time was trading around $106.80. The sweet spot was the ATM 107 puts. The following picture shows what happened with some of these puts around this strike price from Friday to Friday.

(please click to view a larger version)

Do you think somebody knew something?

Blog Archive

-

▼

2009

(843)

-

▼

September

(146)

- Chigago ISM Numbers Were Released Ahead of Time to...

- Top Currency ETFs To Buy and To Sell

- Google Wave: A Terrific New Google Product

- The All Supreme Fed Appeals Order to Release Infom...

- Using Stock Divergences To Predict Stock Movement ...

- Jim Cramer Badly Burned on CIT Call: Stock Crashes...

- Another Reason That The Markets are Going Up: Quar...

- Top Stocks To Buy and Sell in Latin America (ADRs)

- Sugar Hits All-Time High

- A Political-Economic Oligarchy Has Taken Over the ...

- Bill Gross: Deflation; Fisher: The Fed will Agress...

- SQNM, Sequenom Crashes: How to Profit

- Top 10 Occupations Looking for Employees

- Number of Online Help Wanted Ads Declines by 108,0...

- UNG Cannot Find Buyers for New Shares.

- Today's Top 40 Movers: ASTC +185%, LEE +51%, SQNM ...

- FDIC is Asking for a Bailout

- The Future of the Dollar Explained, Why and How it...

- How to Invest in Gold: Physical Gold vs ETFs, Miners

- ETFs to Profit From Options Without Buying or Sell...

- The Top 50 Safest Banks in the World

- Investing in India: At Risk of Oligarchic Capitalism

- Production Lines and Factories Moving to Brazil

- Higher Earnings Due to the Lower U.S.Dollar: Stock...

- Which Central Banks are Worried About Their Curren...

- Insider Buying of Xerox Puts, Large Volumes Bought...

- How to Profit From the Xerox Crash

- Research in Demotion: RIMM Continues to Slide, Str...

- Central Bankers Report Card: Bernanke Ranked a 'C'

- The Current U.S.: a Can Do Nation, or a Can't Do N...

- Bernanke Says "We Did It", Federal Reserve Caused ...

- Protect Your Money: How to Invest in Latin America

- Large Number of SPY Puts: Average ROI of +55

- S&P 500 Report: 13 Overbought and 44 Oversold Comp...

- World Bank: U.S. Should Not Take For Granted Dolla...

- New Bank of the South to be Created To Reduce Depe...

- Google $155B, 11 Years

- Update and Results: Top 50 ETFs To Sell and Buy

- H1N1: Canada Issues Warning Over Tamiflu

- G20 Country Data for GDP Growth, Unemployment, Int...

- G20 Shadows

- What Was Decided by The G20 Meeting

- U.S. Financial System In Even More Precarious Posi...

- Rare Earth Discovery: Quest Uranium Has Major Find

- Investing in Diamonds: Peregrine has Best Find in ...

- IWM Straddles Profit 156%

- Is RIM Taking a Page from Apple? Spectacular Profi...

- Natural Gas Storage: Overflow in 4.9 Weeks

- Agrium, Mosaic, and China: The Potash Wars

- Paul Martin on The Issues Facing the G20 and the F...

- U.S. Dollar Investing: Beware the Perils of UUP an...

- G-20 Meeting: Down Goes Gold, Up Goes the U.S.Dollar

- Part II - How to Profit From The G20 Meeting Volat...

- Be Careful: G20 Meeting to Have Major Effects On C...

- Solar Energy Market to Instantly Boom in Ontario: ...

- The Fed is Creating New Bubbles; Who is Really Bor...

- US Dollar Inflation vs Deflation, Currencies and F...

- Options for ERTS, Electronic Arts Rumoured to Be A...

- RIMM Reports Earnings: Profit Either Way With Stra...

- G-20 Meeting Chaos, and a Very Weakened U.S.

- Straddles to Profit From Surprises From The Fed De...

- Is the Fed Secretly Engaged in Gold Swaps to Keep ...

- Live Tracking Site of H1N1 Companies' Stocks

- Investing in Brazil

- High Potash Prices are Killing Demand

- The Gold Cycles: Next Low Expected Early/Mid Octob...

- G-20 Pre-Agreement Reached Between U.S and Europe,...

- Buyer Beware: Russian Market Set to Surge, or So C...

- Verichip Wins Patent License for Implanted H1N1 De...

- Complete List of Currency ETFs and Their Performan...

- Car Sales After Cash-for-Clunkers: On Target for W...

- H1N1 BioCryst (BCRX) Alert: Stock May Soar or Cras...

- Global Debt: Satyajit Das on Derivatives, The Debt...

- Top 50 ETFs to Buy and Sell Out of the Entire Univ...

- SVA up 543%, Up to 30% of Asia's Population to be ...

- Global Gold Reserves At $1.4T, US Reserves At Only...

- S&P500: 212 Overbought and 8 Oversold, Top 20 Comp...

- China Slows Down: Beijing Office Real Estate Vacan...

- The US Dollar Carry-Trade is Financing Dangerous G...

- Huge Volume of SPY Puts Options Bought for October

- Options Max Pain Theory: Busted

- The Shapes of the Economic Recovery: U, V, W, L, S...

- UNG Rollover Dates, Use of Swaps Will Erode Price ...

- H1N1: Medical Supply Companies Working at Full Bla...

- Max Pain Live Tracking For September 2009: UNG, US...

- Brazilian Capital Inflows Increased by 30.3%, 10th...

- Rob McEwen: Gold to Hit $1,500 in 2010 and $5,000 ...

- UNG, Natural Gas Inventories: Overflow in 6 Weeks

- Trouble in Japan: Aiful, Japan's 3rd Largest Lende...

- US Dollar Hits 11-Month Low Versus Canadian Dollar

- Federal Express Blames Lower Oil Prices for Bad Re...

- Complete List of Top ETFs by Assets, by Issuers, L...

- The Unemployment Spin: Continuing Claims Rise to 6...

- Top 20 Companies Likely to Go Bankrupt

- Paul Krugman: U.S. Unemployment to Peak in 2011

- UNG Wild Straddles

- Cash For Clunkers Ends: Auto Sales Are a Disaster ...

- TIC Outflow Data Is Terrible For The US Dollar

- Currencies: USD continues to Sink, Real +34%, Year...

- Lehman Brothers Collapse 1 Year Later: Where Are T...

-

▼

September

(146)