On Thursday September 18 there was a massive creation of SPY deep in the money calls very late in the day. The average daily amount traded on SPY is somewhere around $100M. On that day, when the massive $0.7T US bailout of wall street was about to be announced, $792M were traded. The majority of these trades were spread out through strike prices from 60 to 100, while SPY was trading much higher around 115.

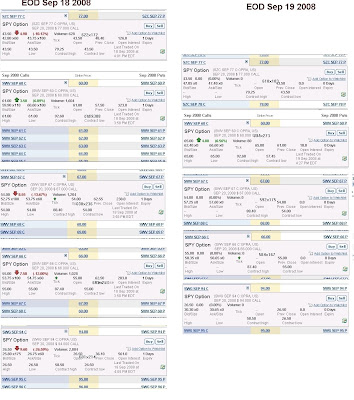

Positions and Trading on Wednesday, Thursday, and Friday at the end of the day (data from Yahoo):

(Please click on image to enlarge)

Some samples from RBC for individual strikes, from both Thursday and Friday:

Note that on Thursday all these trades happened at or around 4PM, give or take a couple of minutes. Even more strangely, note how the options simply disappeared on Friday. They were not traded as there was no volume, yet they do not show up in the open interest. The options simply vanished.

No comments:

Post a Comment