November options expiration month ended Friday November 21. Similarly to October, the performance of IWM straddles and strangles was impressive. 100% of the straddles and strangles were profitable. Simply put, you could have bought one on any day and any time of the expiration month, including up until the early afternoon of the last day, and it would have been profitable. The figure below shows the performance at some key points in the last 4 weeks of the options month. Note that this month was a 5 week period. The points marked by the chart are particularly interesting as they try to look for worst performing points, not best performing ones.

(please click on chart to expand)

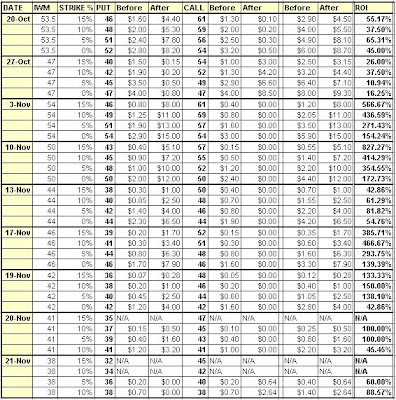

The table below shows numerical results. 4 sets of straddles were analysed for each point: strikes 15% off the current price of the underlying strikes 10% off strikes 5% off straddles (0% off) The last column shows the ROI (return of investment). Note that all points have positive ROIs. The lowest returns were around October 26 and October 13, with returns between +11% and +65%, and between +43% and +82% respectively. I believe the October 26 period returns were relatively low because the price of IWM at the time was right in the middle of month range, and the premiums were quite high, being so far off the expiration day. For the period around November 13, the reason was the sudden drop on that day, again, making the premiums expensive (due to higher volatility), and because it was followed by a rise and a drop, again, with the position sitting in the middle of the subsequent range. The rise was not enough to make the positions profitable, but the drop was.

Strangles and strangles are highly profitable when there is enough movement either way. If the price of the underlying moves up and then down, or vice-versa, then the position is basically back to square one. This is not good, unless you sold the winning side, in this case, the calls. Selling and repurchasing is quite a valid approach, and can greatly increase profits, but was not considered in this report. In this report we only looked at buy-and-hold positions. Note that we did not try to optimize the gains shown. For example, Tuesday November 4th would have generated higher gains. We were actually trying to find any losing positions. Because volatility was so extreme, eve straddles bought until the early afternoon of the last day would have been profitable. Note also, that straddles did well even in period of declining volatility. The gains in this case are not as high, but they still occurred (please see the report on this subject last week on this site).

(please click on chart to expand)

N/A positions indicate not enough volume for buying (too far from price of the underlying).

Whether these gains can be repeated is unknown. If volatility remains, then there chances are high.

Here are some charts of IWM and VIX:

Charts of some of the options:

Regarding alternative strategies and optimizing gains, I bought a 41-41 straddle on Thursday PM, the day before expiration. Because the last two days had been so negative, the idea was to capitalize on a rebound on Friday. The 41 puts were sold in the morning at 2.7X gain, the calls expired worthless. The proceeds of the puts were used to buy 38 calls. Because IWM was trading all morning around 38, I sold the 38s at near break even and switched them to 37s as I still wanted intrinsic value before expiration at the end of the day. These were bought at between $1.40 and $1.15. IWM finished the day at $40.64, or $3.64 over the 37 strike. Those calls were sold at a profit, but not at the peak, and a December 30-44 strangle was bought with the proceeds. Had Mr. Obama made his announcement one hour earlier, the profits would have been much higher, but the puts needed to be sold as it was too risky to keep them till 4PM. Risk management is paramount!

9 comments:

Thanks for the straddle report. Very helpful to a novice options trader like me. How often do you post such reports?

Rob

Hi anonymous. I have been doing it for the last couple of months only. I'll keep doing frequently if volatility remains high. if volatility were to drop significantly, then longer term straddles are better so those would require waiting for a while to see results. Thank you.

Do you have a rule-of-thumb relationship between the VIX and how far out you go with the straddle expiration date? For example, if the VIX drops to 50, would you then go two months out, or Vix at 40 would mean 3 months away?

Thanks in advance.

Rob, you know, that is really a good question. It may be something worth a look at, figure out a relationship between VIX and the number of months to you should go. What I can say is that for VIX over say 25 short terms straddles work wonders. For VIX around 10-12, long terms straddles would likely work well. Excellent point, thanks.

Hi Shocked,

I initiated an IWM straddle on Friday when the mrkt was at it's top. So far it's break even with this morning's decline. My position was 10% away from the price on Friday. Let's see what happens.

Regards,

Glenn

SI,

Are you buying Dec IWM straddles here? Currently IWM at 47.71 and bumping against recent high.

Hi Rob,

Yes. I bought a 42-48 last week, just sold it a few minutes ago, +18.5% profit after commissions, so that was was a rising VIX.

I then bought a 46-49, slight bias on the call side. If the market drops, however, premiums should rise, at least that's the idea.

I don't trust this market, so taking profits frequently.

Make that 42-44 last week.

SI,

Thanks for the heads up about taking profits frequently. On Dec 1 I bought a strangle with Dec 46 calls and 44 puts. Today before the close, and after I read your comment, I got nervous about IWM not being able to hold above the recent high around 48.30, so I sold the calls only. The profit after commission was 96%, but that represented only 2/3 the cost of the puts. If I can unload the puts on a pull back, even at break even, I'll have a decent overall profit.

Is that plan a mistake? Is it better to hold until both sides can be sold?

Thanks for your help.

Post a Comment