Here are some updated March straddles. Computations used prices at the close on Friday using the straddles calculator tool at http://nexalogic.com/nexastraddles.html

IWM (straddle):

IWM (strangle)

XLF:

SPY:

UCO (2X oil):

AUY (Yamana Gold):

YHOO:

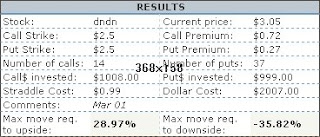

And a pharma company that may be reporting FDA results soon:

DNDN:

7 comments:

Hi,

Am I wrong or are the Yhoo options acting strange - i.e. not cent/cent with the stock?

Anyway, tried a straddle of LMT @ 60 today.

YHOO went from $12 (Mon) to $13.20 (Thu), the call 13s went from $0.55 to $1.15 (+109%), the put 13s from $1.60 to $0.80 (-50%). Seems fine, but it is possible that a high IV is being embedded since all this MSFT rumous started surfacing. In that case, the options may not move much after any real news are announced.

Michael, any reason behind going for LMT?

BTW, your TBT puts may be coming back alive.

I thought the volatility would be fairly high based on recent events. So far not really looking that way. We'll see.

Crazy situation on a DIG @ 22 straddle I did. The calls have a bid of .65 (stock at 18.30) - the longs are incredibly optimistic. Not sure what to do here, still think there is more downside although the puts have covered the cost of the trade, I rather feel like selling the calls. But that seems dumb too! Gotta be a bounce coming sometime. Tough one.

Yeah, TLT has a pulse again. The tinfoil hats are going back into the closet for now.

Post a Comment