As this is an election year in the U.S. and things are not looking rosy at all, it is quite possible that we will see another round of quantitative easing. This still affect the U.S. dollar. We have seen recently how the Euro has recovered from its spring lows. The U.S. cannot afford to have strong dollar as it severely affects if exports. Mr. Geithner has been pushing for the Europeans to keep printing money (stimulus) as that would create a market for the U.S. to sell to, but Europeans do not seem inclined to.

It is an interesting tug of war, one that will significantly affect those commodities tied to the U.S. dollar, namely gold and oil. Will they go up, as expected, or will the USD recover and will they sink?

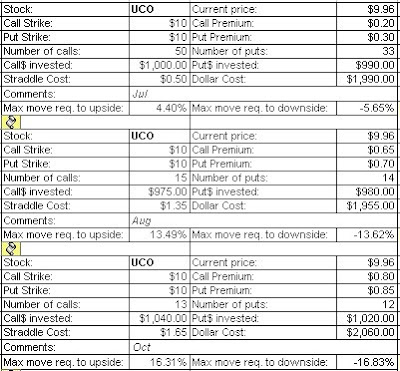

Below are straddles for the Fall gold via the GLD ETF, for oil, via the UCO ETF , and for the USD, via the UUP ETF. Oil also shown for July as it is at an attractive price (click on each ETF link to receive buy/sell alerts).

UUP:

UCO:

GLD:

Computed with StraddlesCalc Tool

Please do your own due diligence. This is not advice. Options are very dangerous and may cause 100% loss.

No comments:

Post a Comment