Canadian families' average debt has hit 100,000, the first time at six figures, accordig to a report by the Vanier Institute of the Family. The figures include mortgages.

The report also says that debt-to-income ratio is 150%, so Canadian families owe $1,500 for every $1,000 in after-tax income they make.

The average mortgage in 2010 was $171,500. Sauvé said the average household has a mortgage of $63,126 because not everybody actually has a mortgage.

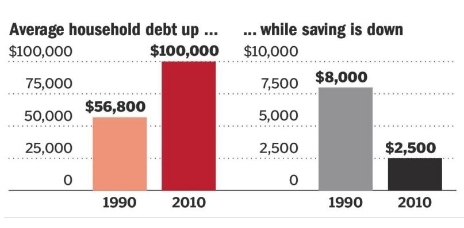

Current debt levels are 78% higher than in 1990, when the average household debt was $56,800. Savings have also shrunk, in 1990 families saved 13%of their income, or $8,000, compared to a savings rate of 4.2% in 2010 ($2,500) .

Canada's debt-to-income ratio is now about even with that of the United States.

No comments:

Post a Comment