Several Brazilian companies will be launching ADR programs in New York this year. Most should debut in the U.S. market via receipts level 1, the path that has fewer requirements. Others, however, will migrate to higher levels. Such is the case of Banco do Brasil, the country's largest bank which already trades as a level 1 since December, as reported here last year (many foreigners mistakenly believe that the largest bank is Itau/Unibanco, ITUB as an ADR). Any holder of Brazilian banks shares has a huge smile on his or her face. Brazilian banks are even better run than the hyped Canadian banks.

BNY Mellon says that they are coordinating more than five operations. The move reflects the growing interest among global investors in Brazil. Just last month, the Cielo credit card company, the holding company for consumer products Hypermarcas, and Eternit, manufacturer of construction products announced ADRs level 1.

Another factor that fuels interest in level 1 ADRs is the launch of a specific platform for trading of these papers, which now occur only in the OTB market, restricting liquidity. Alex Ibrahim, head of NYSE Euronext to Latin America confirmed that they launch this new platform in April.

Cielo says that the ADR program is another investment option for investors, and increases the visibility of Cielo in the international market. BNY Mellon states that the ADRs Level 1 function as a barometer to assess the appetite of foreign investors for their shares. A greater interest in the market, measured by the increase in turnover, could stimulate the issuing company to migrate to the ADRs of level 2 and 3, adding to a group now restricted to 30 names of Brazilian companies, such as giant Petrobras, Vale, Itau and Unibanco Santander Brazil.

We track all latin American ADRs live here and they certainly have been stellar performers.

Together, the ADRs of Brazilian companies account for a higher aggregate transactions of all companies in any country outside the United States in the New York Stock Exchange.

As for Banco do Brasil, the bank has been awaiting approval from the SEC to move up a level.

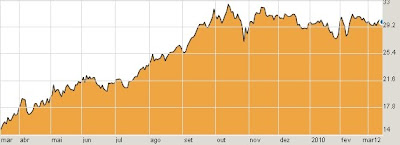

BDORY chart:

Banco do Brasil chart at Bovespa:

No comments:

Post a Comment